Welcome back. Are we witnessing the real-time collapse of the “future of finance”? Or will crypto come back stronger than ever?

In today’s installment of Schematics, the newsletter that gives you the facts and perspectives needed to sound smart around your friends, we’ll talk about:

Investing your retirement account in Bitcoin

The high-speed, secret trading firm taking over Wall Street

YouTubers and cartoon characters preventing Japan’s economic collapse

Let’s break it down.

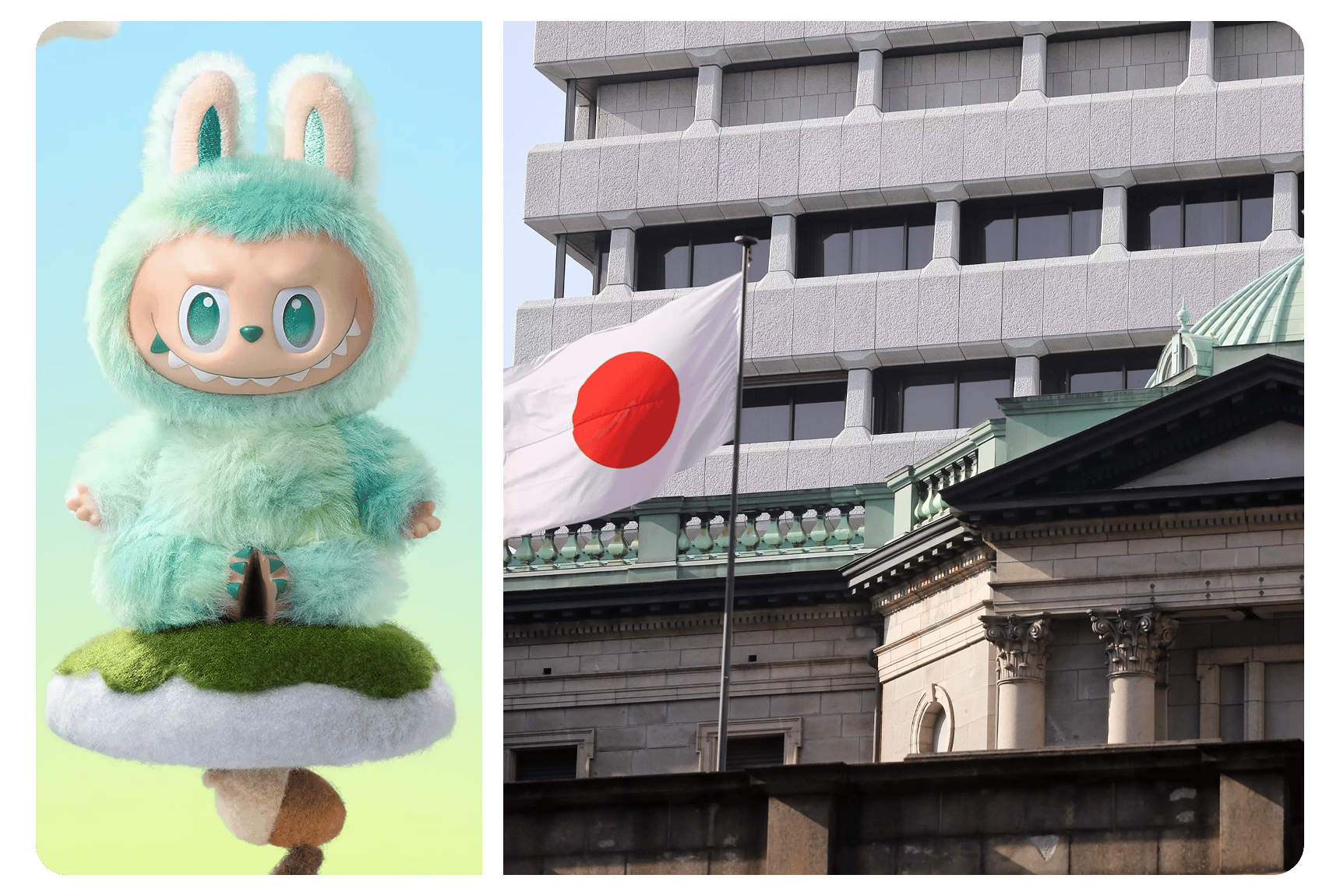

The ‘Not-A-Trading-Firm’ Trading Firm That’s Taking Over Wall Street

HRT office game room (yes, that is a poker table) // Photography Credit: Bloomberg

What happens when you trap poker players, mathematicians, software engineers, and puzzle-lovers in a room together?

You get…$9 billion in revenue.

Founded in 2002, Hudson River Trading (HRT) is a quantitative trading firm headquartered in Manhattan, looking out over…(I’ll let you guess)….the Hudson River!

In case you’re not familiar, quant firms are the rebellious sibling of your typical Wall Street hedge fund. And, most of the time they consider themselves technology companies, not trading firms.

Quant firms focus on algorithmic trading and they typically make most of their money as market makers.

What is a Market Maker?

Let me explain…

In it’s simplest form, a market maker is a firm that continuously buys and sells securities. They provide liquidity in the market, which helps other firms or retail traders execute their trades efficiently.

Every time a share is bought or sold, there is a tiny difference between the price the buyer pays and the amount the seller receives…that difference (otherwise known as the bid-ask spread) is the profit that the market maker receives.

Some of the more commonly known market makers are firms like Jane Street, Citadel Securities, and Virtu Financial. When combined, they are responsible for trillions of dollars in trading volume per year.

So, what about HRT?

HRT has flown under the radar, quietly working on their algorithm and quickly becoming a powerhouse among their fellow market makers.

They’re not flashy, you don’t hear about them in the news, but in the second quarter of 2025, they walked away with $3.7 billion in revenue, which put them above Citadel Securities.

HRT currently works on about 15% of all US equity trades and 4% of the options market, with the current goal of expanding their portfolio through long-term trades.

As a market maker, they typically hold their trades for less than a second, while they connect buyers and sellers. Obviously, there is a lot of money to be made in this…but the real money comes from longer-term, higher-risk trades.

This means holding a trade for an hour, overnight, or beyond.

The longer you hold, the higher the risk…but, you get the benefit of riding the stock up or down longer and walking away with a profit substantially larger than the typically bid-ask spread they receive in market making.

HRT is currently investing $1 billion per year on artificial intelligence, which they believe will be the difference maker in their growth.

Would You Put Your Retirement in Bitcoin?

Insert caption here

Honestly…I know a few people that would.

And, I guess Vanguard did too.

As of this Tuesday, the second-largest asset manager in the world will allow you to invest into ETFs and mutual funds that primarily hold cryptocurrencies.

This comes after years of the firm arguing that cryptocurrencies and digital assets are too volatile and speculative for non-degen trading portfolios (like your retirement account).

This move comes right after the $1 trillion drop in the crypto market that wiped out many accounts in the process, which supports Vanguards previous statement that the markets are too volatile for real investment.

But, these asset managers are in the market to make money, not stir up a social movement. Since crypto-linked ETFs are one of the fastest growing segments in the history of the U.S. fund industry, it was only a matter of time before Vanguard got involved.

That said, Vanguard is still holding firm that they will not create their own digital inventory or fund tied to cryptocurrency, unlike their largest competitor BlackRock, who has about $70 billion in their bitcoin-linked fund.

As I’m writing this, $BTC.X ( ▼ 0.13% ) is crawling it’s way back from the wild ride it’s been on over the last few months, so we will see where it goes from here.

Japan is Rebuilding Their Economy Through… Super Fans?

While banks in the United States and across the globe are working to decrease inflation and slow price increases, Japan is having a boom that we haven’t really seen before.

For decades, Japan has struggled with deflation and the decreasing purchasing power of the Yen ($USDJPY ( ▲ 0.41% )). But, recently, the story has completely flipped.

Tokyo’s inflation rate topped 3% in October, signaling they may have finally broken the deflationary curve without triggering an economic disaster or recession.

Corporate profits are strong and the Bank of Japan is actually facing pressure to raise rates for the first time in years.

But, the strange part is that the growth isn’t due to corporate restructuring…it’s actually being fueled by obsessive fans, who dedicate the majority of their disposable income to their idols.

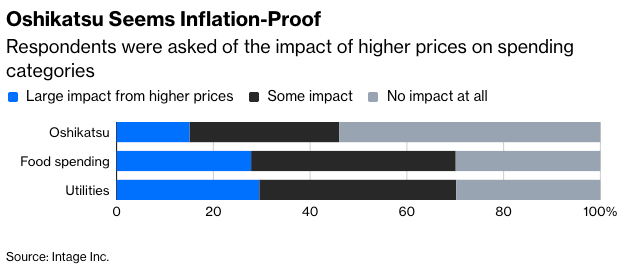

This trend, known as Oshikatsu, is driving billions of dollars into goods, events, and merchandise related to pop idols, anime characters and YouTubers.

Basically, Japan has unlocked the holy grail of capitalism and a spending category that is immune to inflation.

According to this survey, “54% of people said they were ‘not affected at all’ by rising prices and a weak yen” when spending in this category.

It will be interesting to watch this story develop, especially as companies begin targeting older generations with more disposable income than Gen Z and finding new ways to channel their oshikatsu into economic growth.

Disclosure: I am not a Financial Advisor and nothing I share should be taken as financial advice. This newsletter is for informational purposes only. Investing is inherently risky and the risks could include complete loss of capital. Grant Rudow and Schematics are not liable or responsible for any financial loss incurred by anyone.